Corporate Venturing: The Imperative For Future Growth

Did you know that over half of Fortune 500 companies risk losing their market position within the next decade without innovation? In today’s business landscape, standing still is not an option. Companies must explore bold new opportunities, leveraging emerging tech trends and shifting market trends to stay ahead.

While traditional R&D drives incremental progress, corporate venturing offers a strategic framework for transformative innovation.Whether you’re looking to expand into untapped markets, adopt cutting-edge technologies, or test daring ideas, corporate venturing is the key to future-proofing your business.

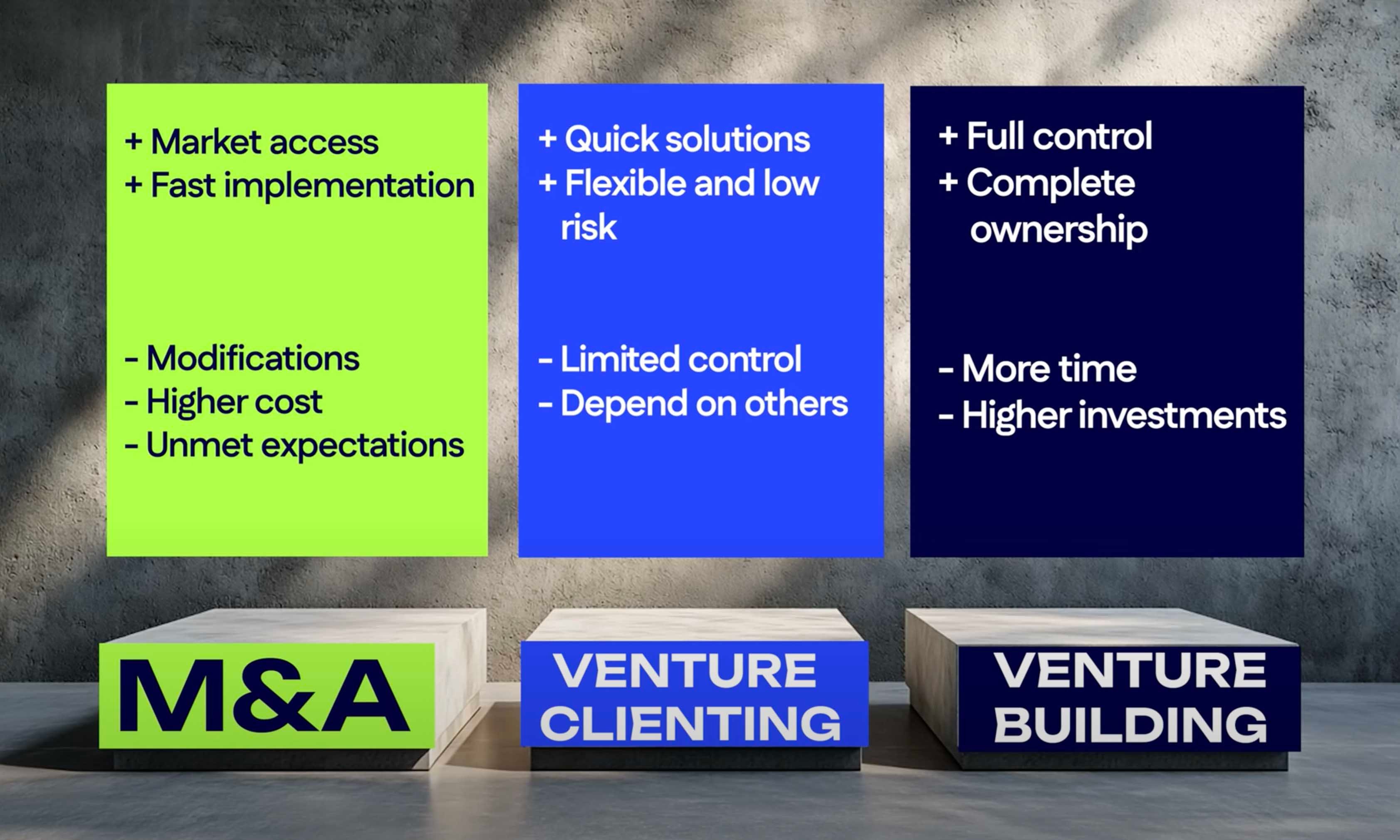

But which approach fits your goals best: M&A, Venture Clienting, or Venture Building?

The three paths to building new businesses

There’s no one-size-fits-all solution for corporate venturing. Organizations have different strategies, resources, and goals, which means the best approach to building new businesses will vary. Broadly, there are three distinct paths to corporate venturing:

- M&A (Mergers & Acquisitions)

- Venture Clienting, and

- Venture Building.

Let’s explore each approach through an analogy: building a house.

1. M&A: Buying a ready-made house

Imagine buying a house that’s already built and move-in ready. M&A provides quick access to markets, customers, and proven business models. With the right acquisition, you can rapidly expand your portfolio and capabilities.

However, as with any house, you may find it needs modifications - integrating teams, aligning cultures, and streamlining operations can be complex and costly. Additionally, there’s always the risk that the house doesn’t meet your expectations or align with your needs. While M&A is fast and impactful, it comes with significant investments and potential risks.

Pros:

- Quick market access and fast implementation with proven business models.

- Fast implementation.

Cons:

- High cost.

- Risk of unmet expectations.

- Challenges with team integration and cultural alignment.

2. Venture clienting: Renting a house

Now, think about renting a house. Venture Clienting allows you to partner with startups to quickly test and get access to solutions and technologies. This approach is flexible and low-risk, making it an excellent choice for exploring opportunities without heavy commitments.

However, as with renting, you have limited control and ownership. You depend on your landlord - in this case, the startup’s team and decisions. Venture Clienting is ideal for testing ideas and gaining insights, but it may not offer the long-term benefits of complete ownership.

Pros:

- Flexible and low-risk.

- Ideal for testing new ideas and technologies.

Cons:

- Limited control and ownership.

- Reliance on external decision-making.

3. Venture building: Designing your dream house

Finally, imagine building a house from scratch, tailored to your exact needs. Venture Building gives you full control to design and build a solution that aligns perfectly with your strategy. You own every part of the process and outcome, ensuring it fits your goals.

However, as with constructing a custom house, venture building requires significant time, investment, and effort. It’s a long-term commitment, but the result is uniquely yours and aligned with your vision.

Pros:

- Full control over the design and execution.

- Complete ownership of the business and its outcomes.

Cons:

- Requires more time and higher investments.

- Demands a strong innovation infrastructure and resources.

How Bluemorrow supports your corporate venturing journey

Corporate venturing is a powerful way to unlock growth, expand beyond the core, and seize new opportunities—but choosing the right approach requires clarity and strategy. At Bluemorrow, we bring over a decade of experience working with industry leaders like Siemens, E.On, and TÜV Nord to navigate the complexities of corporate venturing. Whether it’s identifying high-potential opportunities, partnering with innovative startups, or building ventures from the ground up, we tailor our approach to fit your unique goals and challenges.

From defining long-term strategic goals to building future-ready innovation strategies, our expertise spans the full venturing journey:

-

Uncovering market shifts and whitespace

-

Designing and evaluating venturing models

-

Developing innovation capabilities and future-ready teams

- Executing hands-on venture builds or startup partnerships

By blending foresight, execution, and the agility to navigate uncertainty, we help companies make confident moves that unlock long-term value.

Curious which approach fits your ambition best?

Let’s explore your corporate venturing options, whether that’s scouting technologies, testing new concepts, or building ventures from scratch. Book a call with our team and start shaping your future today.