From Digital to Intelligent: Why Banks Must Embrace AI Now

Interview with Henning Bär, Partner Venture Building & Studio at Bluemorrow.

The concept of digital banking once marked a breakthrough in customer experience. But today, it’s no longer enough. As artificial intelligence matures, the industry is shifting toward a new paradigm: intelligent banking.

To explore what this shift means in practice, we sat down with Henning Bär, Managing Partner at Bluemorrow, where he leads Acceleration, Scaling, and Venture Studio initiatives. Henning brings over 15 years of experience across Banking, Fintech, and Venture Building. He spent nearly a decade in strategic roles at a leading global bank, shaping wealth management offerings and overseeing major integration programs, including the M&A transaction of Credit Suisse InvestLab to Allfunds. Later, he helped build embedded finance solutions at the Swiss Fintech additiv and led early-stage ventures and corporate venture studio rollouts at Creative Dock including TDK’s 835labs.

In this conversation, Henning shares his perspective on how banks can evolve from reactive, transactional services to predictive, AI-powered systems, and why timing will be critical for those navigating the transition. We unpack the key trends, the role of infrastructure, and what intelligent banking could look like in practice.

Henning, what do you think about the statement "the digital banking is an outdated concept". Can you explain what does it mean to you?

Henning Bär: I completely agree with the sentiment. “Digital” was a necessary first step—digitizing existing processes, creating apps, and offering online banking. But that’s not transformation; it’s modernization. The digital bank still reacts, it waits for customer input. What we need now is a bank that acts intelligently. A bank that predicts, personalizes, and proactively solves customer needs. In that sense, digital is no longer a differentiator, it’s table stakes. The next evolution is intelligent banking.

What defines an intelligent bank compared to a digital one?

Henning Bär: An intelligent bank is proactive, adaptive, and embedded into the customer’s life. I see five major shifts:

- From transactional to predictive: banks shouldn’t just process payments, they should anticipate financial needs.

- AI in fraud prevention: using machine learning to detect anomalies in real time, not after the fact.

- Hyper-personalisation: beyond basic segmentation, offering services based on lifestyle, goals, and behavior.

- Omni-channel intelligence: context-aware interactions across platforms, where the customer never has to repeat themselves.

- Autonomous operations: automating the back office to free up human capacity and reduce error.

Intelligent banking means every part of the institution is learning, adapting, and optimizing constantly.

Let's go deeper into one area, let's say predictive banking. how does this actually play out for customers or the bank itself?

Henning Bär: Think of a customer who regularly pays rent late. An intelligent bank would detect this pattern, flag a potential cash flow issue, and suggest a micro-loan or flexible payment option before the issue escalates. On the bank’s side, predictive analytics also help manage credit risk more dynamically, allocating capital where it’s most effective.

Another example: a customer’s travel spending spikes, AI could trigger a cross-sell on travel insurance or FX services right in the moment of need. These are not huge changes individually, but together they reframe the bank from a utility to a trusted financial partner.

Many banks still struggle with legacy systems. What's holding them back from becoming intelligent?

Henning Bär: The tech stack is one piece, but it’s not the whole story. The deeper issue is often cultural. Many banks operate in silos, with long decision cycles and risk-averse mindsets. Even when a pilot proves value, scaling it across the organization gets stuck in endless approvals. Legacy infrastructure doesn't help; fragmented data, outdated APIs, and black-box core systems all slow down progress. But I’ve seen firsthand that with the right leadership and a clear transformation roadmap, even large institutions can evolve. It just requires alignment across strategy, tech, and people.

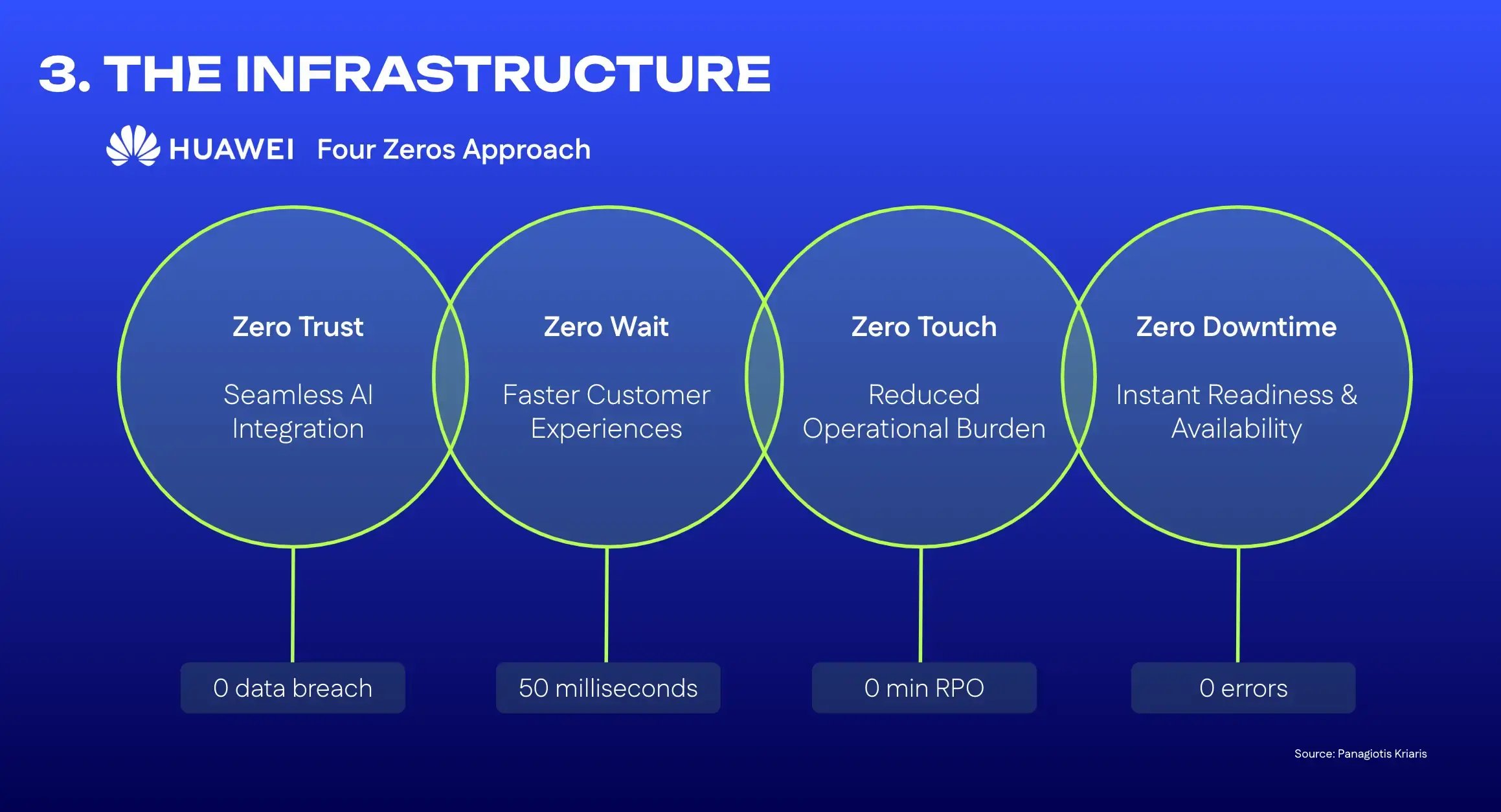

How about huawei's 4-zero model? What stands out to you about it?

Henning Bär: The 4-Zero model (Zero Wait, Zero Touch, Zero Trouble, Zero Trust) captures the essence of intelligent infrastructure. What I find compelling is how it reframes banking around experience and trust.

- Zero Wait: Real-time everything. Customers don’t want to wait for approvals or responses, they expect immediacy.

- Zero Touch: Embedded finance and automation that removes friction entirely.

- Zero Trouble: Resilient, secure infrastructure that’s invisible but critical.

- Zero Trust: Not in the emotional sense, but in how systems authenticate dynamically, reducing fraud while improving user experience.

How should banks approach this transformation, especially those who are just starting out?

Henning Bär: Don’t aim for the full transformation on day one. Start small and build momentum. I usually advise clients to:

- Prioritize pain points: Start where you have both urgency and opportunity. E.g., fraud detection, onboarding, or credit approval.

- Modernize the data layer: Intelligence starts with clean, accessible data. Invest here early.

- Build cross-functional squads: Combine tech, product, and business from the start.

- Think platform, not product: Avoid point solutions, aim for a modular system that grows with you.

- Invest in mindset shifts: Transformation is 20% tech, 80% culture. Agile is not just a buzzword, it’s how you move fast and learn faster.

Last question. What's your vision for banking 2-5 years from now?

Henning Bär: Banking will become more invisible yet indispensable. Services will be embedded directly into consumer platforms, whether it’s a retailer offering savings plans, or a health app nudging better financial wellness. Traditional banks will either evolve into orchestrators of ecosystems or be disintermediated by smarter, faster players. The winners will be those who learn to operate more like venture studios: testing, iterating, scaling new business models continuously. But most importantly, the banks that thrive will be the ones that don’t just digitize products, they reimagine their role in customers’ lives.

Final thoughts

The move from digital to intelligent banking marks more than a technological upgrade, it’s a fundamental shift in how financial institutions operate, create value, and build trust. As Henning emphasizes, tomorrow’s leaders won’t just offer smoother interfaces, they’ll deliver predictive, personalized, and embedded experiences powered by AI and data.

For banks, this isn’t about chasing trends, it’s about redefining their role in customers’ lives. The path forward requires bold decisions, agile execution, and a clear vision of what intelligent infrastructure can unlock. Those who act early and scale smartly will shape the future of finance, but those who wait may find themselves left behind.

At Bluemorrow, we help organizations turn bold ideas into investable ventures, through intelligent acceleration, systematic venture building, and scaling support.

Ready to take the next step toward intelligent banking?

Let's talk or explore how we can support your transformation.